|

Вид публикации: Статья Год: 2013 Издательство: IZVESTIA OF TIMIRYAZEV AGRICULTURAL ACADEMY (IZVESTIATSKHA). SPECIAL ISSUE. 2013. - PUBLISHING HOUSE OF RSAU-MTAA. MOSCOW. P. 20 - 30. Целевое назначение: Научное Автор(ы): GATAULIN А M. GATAULINA E.A. Статус: завершенный Наименование: SOME ISSUES OF THE IMPROVEMENT OF STATE SUPPORT OF THE AGRICULTURAL SECTOR Ключевые слова: state support of agriculture, interest rate subsidy, lump sum payments, State pro- gram of agricultural development Объем (п.л.): 0.59 Формат: обычная PDF-файл: http://www.viapi.ru/download/2013/126820.pdf |

IZVESTIYA TSKhA, special issue, 2013

SOME ISSUES ON THE IMPROVEMENT

OF STATE SUPPORT OF THE AGRICULTURAL SECTOR

А M. Gataulin1, E.A. Gataulina2

(1RSAU-MTAA; 2 VIAPI named after A.A. Nikonov)

Abstract: The paper is focused on the analyses of the implementation of the interest rate subsides for the loans received by agricultural producers and processors. Problems associated with the large-scale use of this subsidy are highlighted and changes proposed by the government to solve these problems are analyzed. It is concluded that resulting problems are being solved by the State however not to the full extent as long-term obligations of the state remain unchanged. It is proposed to substitute the interest rate subsidy for investment loans by lump sum payments of the 30% of the principal debt.

Key words: state support of agriculture, interest rate subsidy, lump sum payments, State pro- gram of agricultural development.

A new State Program of agricultural development and regulation of agricultural mar- kets for the period of 2013–2020 has been approved in July 2012.1 Now the officials are in the process of developing the normative legal acts specifying the provisions of this State Program. The Drafts of the Government Regulations concerning the distribution of federal subsidies are available at the official website of the Ministry of Agriculture and are offered for discussion.

This paper presents an analysis of changes in one of the most expensive subsidies of recent years – the interest rate subsidies for the loans received by agricultural producers, agribusiness organizations and consumer cooperatives. The analysis will clarify the signifi- cance of this subsidy, problems arisen from its implementation and changes proposed in the new State Program.

Assessing the use of interest rate subsidies as an instrument of state support, one should note the perfect timing of its introduction. It would be useless if introduced it in the early 1990s. At that time, commercial loans were practically unavailable for most agricul- tural enterprises. In 1996, the share of unprofitable agricultural organizations accounted for 79%, the profitability was – 21% including subsidies. Certainly, credit organizations refused to provide loans to agricultural producers. Their current assets were financed by overdue debts, which amounted to 42% of the total value of their accounts payable. This situation lasted for several years. During this time, the market forces that prompted the survival of the strongest and the state support began to change the situation.

In 2002, the Federal Law № 83-FZ "On the financial revitalisation of agricultural producers" has entered into force. It introduced a set of measures to restructure the debt of agricultural producers. Also in the early 2000s, an interest rate subsidy started to be ap- plied on a relatively modest scale. An experience how to implement this measure began to acсumulate.

![]()

1 Hereinafter referred to as the State Program.

20

By 2005, the situation in agriculture has greatly improved. Gross output started to grow. Profitability (including subsidies) of agricultural organizations amounted 8%. The share of unprofitable enterprises has decreased to 41%. New organizations without debt were established using the assets of the bankrupt enterprises. Agricultural holdings emerged. Investors from other sectors of the economy began to enter into agribusiness. Thus, a significant number of efficient agricultural producers came into the scene. How- ever, their development was constrained as loans were not readily available.

The situation has changed significantly with the adoption of a national project "De- velopment of Agro-Industrial Complex" (2006–2007). In this project, interest rate subsi- dies were seen as one of the key measures to support agriculture. The cost of interest rates on target loans was reimbursed from the Federal budget in the amount of two thirds of the refinancing rate of the Central Bank of Russia and on loans taken by small business, in the amount of 95% of the Central Bank’s refinancing rate. Regional co-financing of this sub- sidy was obligatory.

Along with the state funding, a set of goal indicators (the volumes of newly at- tracted loans) was specified in order to estimate the effect of this measure. The Ministry of Agriculture was responsible for the achivement of these indicators. An administrative official resource was involved and a large-scale campaign was initiated in the regions. Rosselkhozbank was appointed as the main state agent of the credit state support policy in the agricultural sector. Sunstantial contributions from the Federal budget were made almost annualy to the authorised capital of this bank to achieve the set goal. Other banks also took an active part in the project.

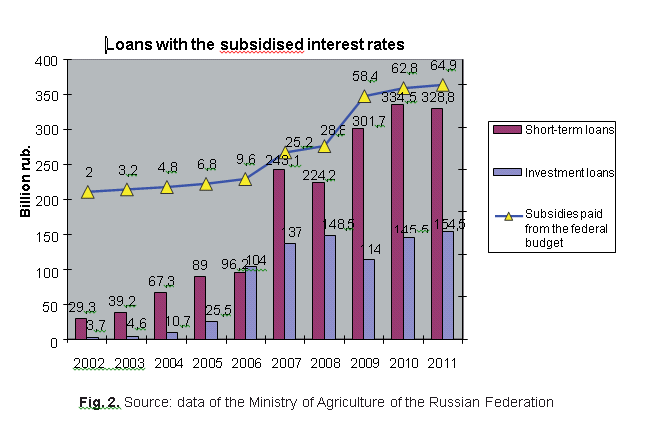

The project resulted in the most prominent growth of attracted loans in agricultural sector. According to the Ministry of Agriculture, the volume of subsidized investment loans in 2007 increased by 9.9 times if compared to 2005. Small business in agriculture increased the volume of loans by 86 billion rubles at the same period.

The implementation of interest rate subsidies continued in the State program for ag- ricultural development for 2008–2012. There, this measure was declared as the main tool to support the financial sustainability of agricultural producers. Later in the State program for 2013–2020, there has been a tendency to limit this approach, as problems associated with its large-scale implementation became evident.

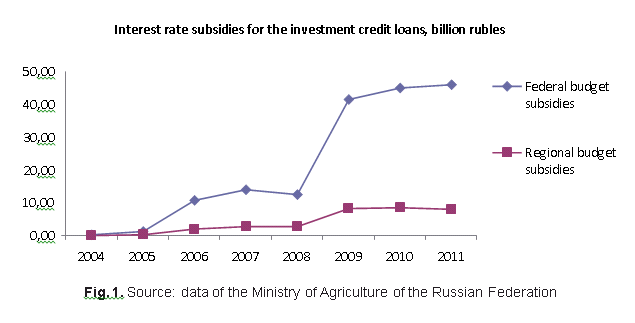

A major problem has been a rapid growth of long-term obligations of the State to subsidize the investment loans. The volume of subsidized short-term loans also increased. In particular, Federal budget payments grew rapidly (Figure 1).

The State could not escape its long-term obligations. At the time when the need to cut down budget expenses was faced (as in 2010), the support for all sections of the State program had to be reduced except for the section of the interest rate subsidies. The funding of the latter from the Federal budget was increased by 14% in comparison with the amount planned for that year, while financing of other sections was decreased by 33%. The interest rate subsidy got an exaggerated share in the resource provision of the State program. In 2010 and 2011, it accounted for more than one half of the Federal budget financing allocated for the State program. Other support measures were negatively affected by insufficient financing.

This situation has resulted from the popularity of this subsidy and the lack of State control over the actions of borrowers’ and lending institutions that may modify the terms of the loan agreement. As a result, the State often has to pay more. The increase of the required federal funds for this subsidy was also caused by the growing share of funding from the a - from 2/3 to 80% of the Central Bank’s refinancing rate; by annual expansion of the list of loans subject to this subsidy; by prolongation and refinancing of loans taken

with the obligations of the state to subsidize them as well. All these were adopted as anti-crisis measures and measures to mitigate the consequences of the extreme drought of 2009–2010.

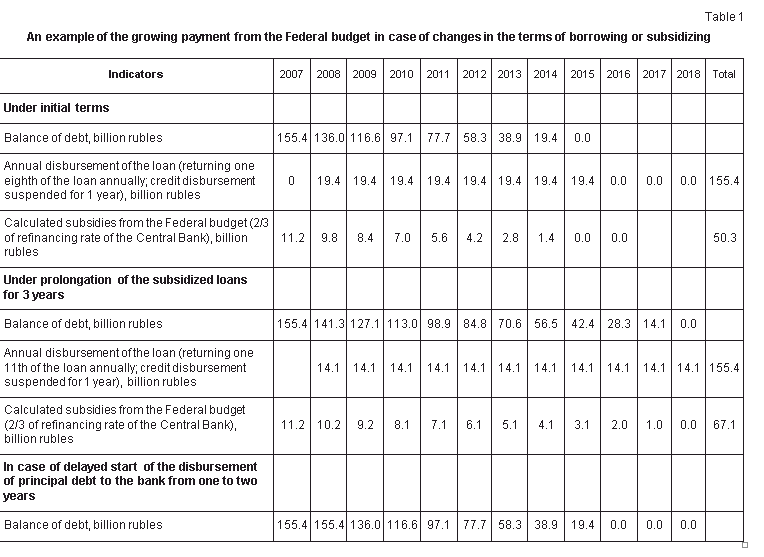

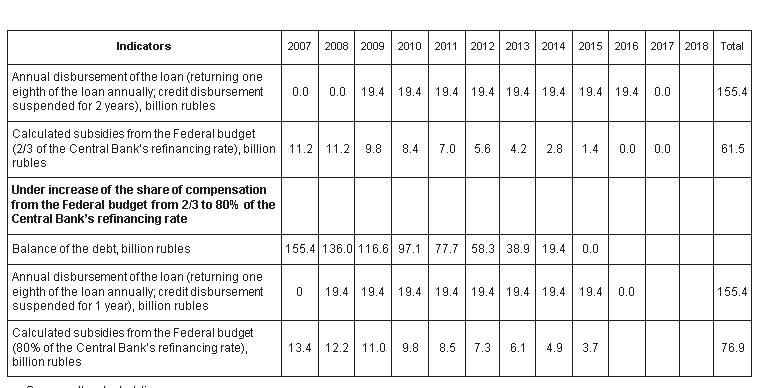

Table 1 illustrates the rate of increase of federal payments for this subsidy caused by three aspects:

– prolongation of the subsidised loans for three years (this period was granted by the Government Regulation),

– delayed start of the disbursement of the principal debt to the bank from one to two years;

– the increase of the share of compensation from the federal budget from 2/3 to 80% of the Central Bank’s refinancing rate (actually took place).

Theamount of actuallyattractedloans obtained in 2007 was taken (155.4 billion rubles) as an example. To make it simple, we assumed that the loans were taken at the beginning of the year. In 2007, the weighted average refinancing rate of Russia’s Central Bank was equal to 10.8%. The delay of the start of the disbursement of the principal debt to the bank was assumed to be one year and the debt was assumed to be payed off in eight years by equal shares.

Table 1 shows that the three-year prolongation of the loans increased the aggregate payments from the Federal budget by 30% if compared with the initial amount of due subsi- dies; the bank's decision to suspend the loan repayment from one to two years – by 20%, and increase of the share of compensation from the Federal budget from 2/3 of to 80% of the refi- nancing rate of the Central Bank – by 50%. The calculations were performed for the amount of new loans equal to those taken in 2007. The real span of the subsidy growth was much more pronounced (Figure 2).

Despite the growth of subsidies caused by the longer loan term, increasing this term in cattle breeding is a necessity as this industry has a long-term period of the investments return. It is particularly true for beef cattle where the first revenue might be expected only

2.5 years after heifers were purchased. So in this case the extension of the repayment term from eight to 10-15 years can be considered an objective necessity.

One of the problems was that agricultural business prefferred to borrow funds to in- vest in the development of pork and poultry industries instead of “chronically” unprofitable

Table 1

An example of the growing payment from the Federal budget in case of changes in the terms of borrowing or subsidizing

cattle breeding. The share of investment loans for cattle in the total amount of livestock loans was only 15% in 2011 compared to 46% and 36% for pork and poultry respectively. Practical experience has also shown the underestimation of the demand for sub- sidized short-term loans. The actual ratio of short-term to investment loans was (68:32) compared with the initially provided for in the State program (57:43). The amounts of annually attracted subsidised short-term loans were twice as much as those planned in the State program. This measure was of high demand not only among agricultural producers but also among processors – their share of subsidized short-term loans usually amounted to

44–46% of the respective total volume.

Mild conditions of regional co-financing were also one of the drawbacks of the sub- sidies system. While in recent years the Federal budget was obliged to fund 80% of the Central Bank’s rate, the regions’ co-financing was only up to 20% of the same rate in most areas of lending.

Interest rate subsidy was included in yellow box state support measure under WTO classification and counted in the total roster of commitments that Russia agreed not to exceed. As noted above, the share of the interest rate subsidy in the overall funding of the State program was significant.

Some of the changes were adopted in the new State program for 2013–2020 to ad- dress the emerged problems. Funding from the Federal budget in most areas has been reduced from 80% to 2/3 of the of the Central Bank’s rate, including loans taken by small businesses. The exception was made only for dairy and beef cattle industries the develop- ment of which has been considered as priority. The limits of regional co-financing were defined more rigidly, thus, part of the financial burden was transferred from the federal to the regional budgets. Since 2010, a new two-level competitive selection was introduced to select new investment projects eligible for interest rate subsidies.

25

It was introduced that subsidizing new investment loans received for construction, reconstruction and modernization of the poultry industry would be ceased starting from January 1st, 2015, and for pork industry – from January 1st, 2017. At the same time, the terms of subsidised investment loans into the development of beef cattle was extended from eight to 15 years. In addition, higher reimbursement rates were set for the loans aimed at the development of dairy and beef cattle. This, to some extent, has corrected the existing disproportions in the directions of concessional lending.

The elimination of interest rate subsidies for short-term loans in crop production could not be estimated as a truly right decision taking into account a high demand for this subsidy. Instead of it, a new subsidy "Income support of agricultural producers in the field of crop production" was introduced in the new State program in order to meet WTO re- quirements. Not only did the new one replace the interest rate subsidy on short-term loans in crop production, but also subsidies for fertilizers, flax and hemp and discounts on fuel (i.e., those included in the yellow box).

It is assumed that the new subsidy is included in green box, as it is stated to serve to improve soil fertility, environment and farm income. However, it is proposed to distribute it in proportion to the annually recalculated cultivated area and volume of crop production. This violates the WTO requirements for the green box measures.

How well the new subsidy will replace the previously applied one depends on regulations that clarify its use and the amount of funding. In general, the initial payment from consolidated budget for the new subsidy is rather low (for 2013, the estimation is 268 rubles / ha of sown area). But the cost of crop production per a hectare of sown area in agricultural organizations amounted to 10.3 thousand rubles in 2011. One can say that less than 3% of production cost is compensated. For future periods payments are subject to increase, but inflation will rise as well. In 2020, estimated payments adjusted for infla- tion will increase up to 375 rubles / ha. At the same time, it is estimated that one ruble of short-term loans subsidy in crop production from consolidated budget (without processors) generated 28.1 rubles of short-term loans.

In the mean time, the new State program has subsidised short-term loans preserved for the processors. Actually, they got a separate limit equal to 3.3 billion rubles a year (average for 2013–2020), which can be spent to purchase raw materials, including im- ported ones, for primary and industrial processing of crop produce. The same applies to loans for the processors of animal products. They are eligible for a subsidized loan to buy, e.g., imported milk powder. This is clearly not in favor of agricultural producers.

All the while, the refusal to subsidize investment loans for the purchase of imported tractors and other kinds of agricultural equipment is maintained for agricultural producers. In the new State program, interest rate subsidies for purchased nationally produced equip- ment were replaced by compensation of lost revenue to equipment manufacturers.

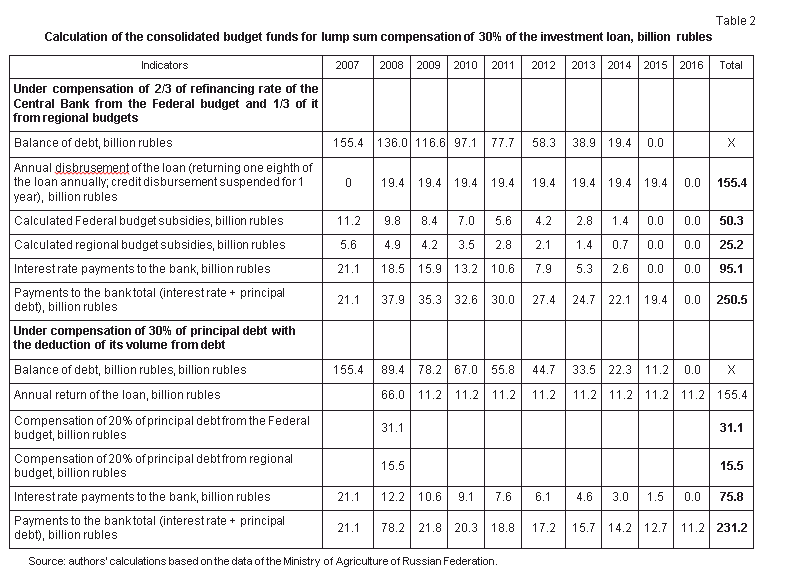

The innovations in interest rate subsidies introduced in the State program do not eliminate the long-term obligations of the state. At the same time, it can be replaced by a mechanism of compensating the partial cost of the investment credit after its intended use is confirmed. The loan is usually used in a year or two, and then the state can reimburses a portion of the principal loan to the borrower. This will not lead to the increase of required funding (Table 2).

For calculations in Table 2, it was assumed that the reimbursement was made in the amount of 20% of the principal debt from Federal and 10% from the regional budgets on the amount of newly attracted investment loans in the year 2007. It was assumed that the loans were taken for 8 years and were subject to be disbursed in equal parts. The utili- sation of loans for the project goal was assumed to be one year. The average commercial

26

Calculation of the consolidated budget funds for lump sum compensation of 30% of the investment loan, billion rubles

Source: authors’ calculations based on the data of the Ministry of Agriculture of Russian Federation.

bank interest rate was 13.6%. The result for the same amount of loans under the conditions of interest rate subsidy (2/3 of the rate of the Central Bank of the Russian Fed- eration from the Federal and 1/3 of it from the regional budgets) is presented in the first part of Table 2.

As shown in Table 2, a lump sum compensation of 30% of the loan is more profit- able to the state. First of all, it does not increase the required financing, and secondly, it saves transaction costs on management of this measure compared with the long-term inter- est rate subsidy. In addition, the lump sum payment of old commitments opens a way to easier planning of new investments. However, such a situation is unfavorable for banks as their income decreases. But it can be negotiated that the borrower after receiving lump sum compensation from the state continues to pay the interest to the bank without deducting this amount from the debt, and uses the compensation for production development, for which the loan was taken (in case the bank would not allow to start the loan repayment early).

Also implications controversial for the State program management occurred due to a change in its structure. In the State Program for 2008–2012, interest rate subsidy measures were placed in one section. There was a clear link between budget funding and target indicators set for each subsidy. This was true for other measures as well. In the new State program, the official link 'subsidy – budget financing – target indicator’ was not direct. The effect of separate measures should be reflected in the growth of the cumulative indicators that absorb the effect of various measures of the section, e.g., in terms of the number of cattle of specialized beef breeds. However, it is difficult to assess what this indicator is actually being changed. Such kind of total replacement of the intermediate target indicators by the final ones where the effect of the measures is blurred took place almost in all sections of the State Program. This complicates the efficiency assessment of separate subsidies. E.g., interest rate subsidies were distributed between five different sections and there were no target indicators of attracted subsidized loans as it was in the previous Program.

Thus, the problems arisen in the application of interest rate subsidies are being solved, but not radically: long-term obligations of the state remain unchanged, the growth of the latter is planned to limit by the reduced access to subsidised investment loans; the role of processing enterprizes and other agricultural organizations in the general limited budget of the State program is increased; the Federal government has shifted part of its financial burden to the regions; it has become more difficult to trace the effect of subsidizing interest rates.

НЕКОТОРЫЕ АСПЕКТЫ СОВЕРШЕНСТВОВАНИЯ ГОСУДАРСТВЕННОЙ ПОДДЕРЖКИ АГРАРНОГО СЕКТОРА ЭКОНОМИКИ

A.M. Гатаулин, Е.А. Гатаулина

Аннотация: статья посвящена анализу применения субсидии на компенсацию части затрат на уплату процентных ставок по кредитам, полученным сельскохозяйственными производителями и организациями АПК. Выявлены проблемы, связанные с широкомасштаб- ным применением этой субсидии и проанализированы предлагаемые средства по их решению. Сделан вывод о том, что возникающие проблемы решаются, но не в полной мере, тaк как

28

долгосрочные обязательства государства сохраняются. Предлагается заменить компенса- цию части затрат на уплату процентных ставок на разовую компенсацию части основного долга после подтверждения освоения кредита.

Ключевые слова: государственная поддержка сельского хозяйства, субсидия на про- центную ставку, единовременные платежи, Государственная программа аграрного раз- вития

Гатаулин Ахияр Мугинович – д. э. н., член-корр. РАСХН, проф. кафедры экономиче- ской кибернетики РГАУ-МСХА имени К.А. Тимирязева (127550, г. Москва, ул. Тимирязев- ская, д. 49; тел. (499)976-0345; e-mail: gataulin35@timacad.ru).

Гатаулина Екатерина Александровна – к. э. н., ведущий научный сотрудник ВИАПИ имени А.А. Никонова (105064 г. Москва , Большой Харитоньевский пер. д. 21/6, тел (495)628-59-42, (495)607-76-76).

Prof. Dr. Akhiyar Muginovich Gataulin – Ph.D. in Econonical Sciences, corresponding member of Russian Agricultural Academy, professor of the Dept. of Economical Cybernetics of Russian State Agrarian University named after K.A. Timiryazev (ul. Timiryazevskaya, 49, Moscow 127500, Russian Federation, phone: + 7(499)976-0345, e-mail: gataulin35@timacad.ru)

Dr. Ekaterina Alexandrovna Gataulina – Ph.D. in Econonical Sciences, leading researcher of the All-Russian Institute for Agrarian Problems and Informatics named after

A.A. Nikonov (Bolshoi Khariton’evskyi per., 21/6, Moscow 105064, Russian Federation, phone:

+ 7(495)607-7676).

Назад в раздел